Non Profit Public Records

Nonprofit Tax Returns Public Record: Everything You Need to Know

The public is allowed to request financial information about nonprofits by submitting Form 990. Both the nonprofit itself and the IRS are legally required to provide this information once it has been requested. During normal business hours, nonprofits must allow any member of the public who asks to inspect their records.

https://www.upcounsel.com/nonprofit-tax-returns-public-record

Nonprofit Explorer - ProPublica

Updated July 5, 2022. Use this database to view summaries of 3 million tax returns from tax-exempt organizations and see financial details such as their executive compensation and revenue and...

https://projects.propublica.org/nonprofits/

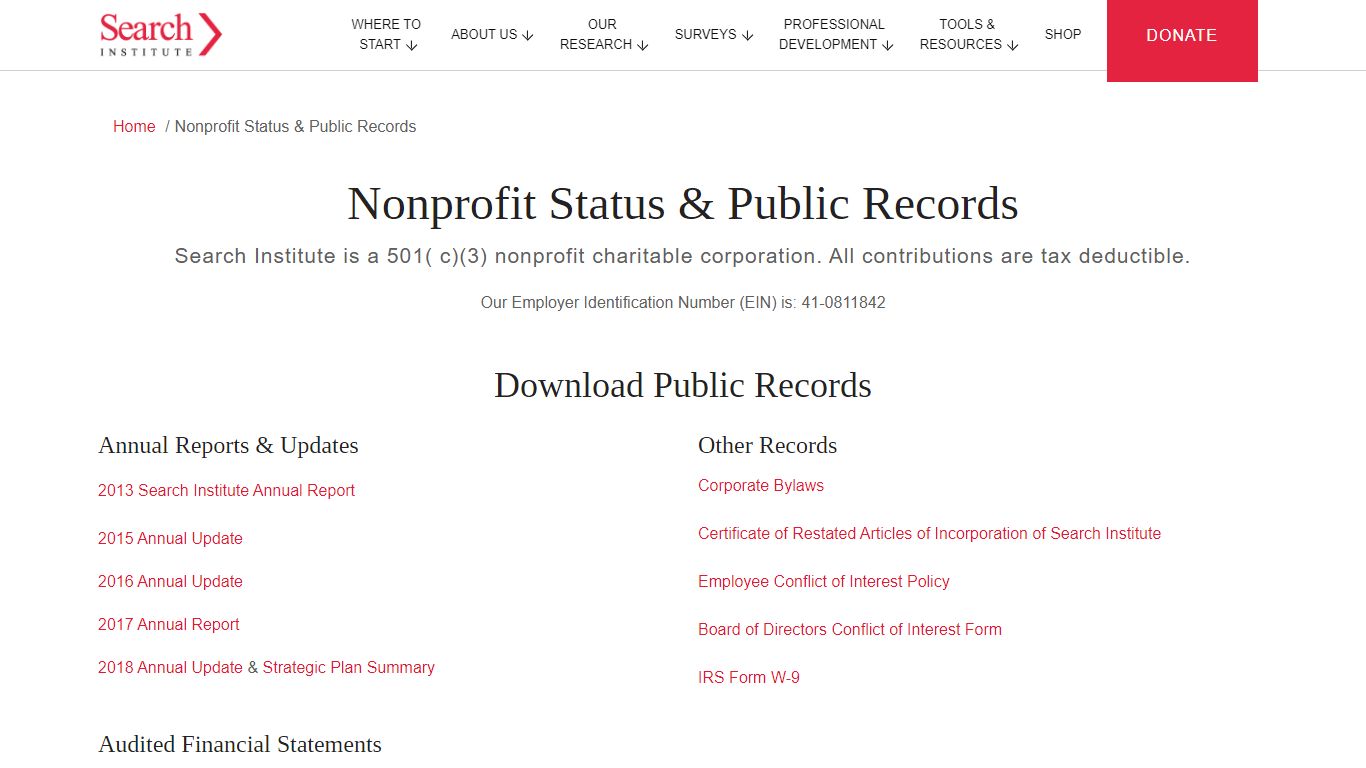

Nonprofit Status & Public Records - Search Institute

Nonprofit Status & Public Records Search Institute is a 501 ( c) (3) nonprofit charitable corporation. All contributions are tax deductible. Our Employer Identification Number (EIN) is: 41-0811842 Download Public Records Annual Reports & Updates 2013 Search Institute Annual Report 2015 Annual Update 2016 Annual Update 2017 Annual Report

https://www.search-institute.org/nonprofit-status-public-records/

Public Disclosure Requirements for Nonprofits

Public Disclosure Requirements for Nonprofits Printer-friendly version Tax-exempt nonprofits are required to provide copies, upon request, of their three most recently filed annual information returns (IRS Form 990) and their application for tax-exemption.

https://www.councilofnonprofits.org/tools-resources/public-disclosure-requirements-nonprofits

Investigating nonprofits and charities: Where to find internal data ...

These public records provide crucial information about finances, assets, investments and expenditures. The example below (selected at random) is from the 2013 Form 990 filed by the Methodist Hospital Foundation in Houston, Texas: The 990 form also will list an agency’s board members and the salaries of top employees.

https://journalistsresource.org/home/investigating-nonprofits-and-charities-where-to-find-internal-data-and-public-records/

GuideStar nonprofit reports and Forms 990 for donors, grantmakers, and ...

Quantity. Easily search 1.8 million IRS-recognized tax-exempt organizations, and thousands of faith-based nonprofits Gather insights on financials, people/leadership, mission, and more

https://www.guidestar.org/

Recordkeeping Basics for Nonprofits - Foundation Group®

Nonprofits that are required to file Form 990 or 990-EZ are required to list on Schedule B all donors who gave $5,000 or more, assuming those donors are individuals, companies, or non-public charity nonprofits. For some nonprofits, the threshold for listing larger donors is 2% or greater of donated revenue. Also, the IRS requires nonprofits to ...

https://www.501c3.org/recordkeeping-basics-for-nonprofits/

The Attorney General's Non-Profit Organizations/Public Charities ...

The Attorney General's Non-Profit Organizations/Public Charities Division Address Office of the Attorney General, Non-Profit Organizations/Public Charities Division One Ashburton Place Boston, MA 02108 Directions Phone (617) 963-2101 Online [email protected] File a complaint about a charity or non-profit Public records request

https://www.mass.gov/orgs/the-attorney-generals-non-profit-organizationspublic-charities-division

Exempt Organization Public Disclosure and Availability Requirements ...

Tax-exempt organizations must make annual returns and exemption applications filed with the IRS available for public inspection and copying upon request. In addition, the IRS makes these documents available. The IRS Required Disclosures course explains disclosure requirements for tax-exempt organizations.

https://www.irs.gov/charities-non-profits/exempt-organization-public-disclosure-and-availability-requirements

Search for Forms 990-N Filed by Small Tax-Exempt Organizations

Use this page to: search a list of organizations that have filed Form 990-N (e-Postcard); download the database of e-Postcard filings.; Updated data posting date: 06-11-18. Search. Tax Exempt Organization Search. Search Tips for Tax Exempt Organization Search

https://www.irs.gov/charities-non-profits/search-for-forms-990-n-filed-by-small-tax-exempt-organizations

Non-Profit Public Records - Homeward Bound Pet Adoption Center

The Camden County Animal Shelter is a 501(c)3 tax-exempt non-profit corporation. According to the public disclosure requirements under sections 6104(d) and (e) of the Internal Revenue Code, as amended by the Tax and Trade Relief Extension Act of 1998, certain documents pertaining to an organization’s tax-exempt status and financial status must be available to the public.

https://homewardboundnj.org/about/non-profit-public-records/

Public Records | State of California - Department of Justice - Office ...

Californians have the right under the state Public Records Act and the California Constitution to access public information maintained by local and state government agencies, including the Department of Justice. The following are guidelines for accessing public, pdf records maintained by the California Department of Justice. To obtain records of another agency, please contact the agency directly.

https://oag.ca.gov/consumers/general/pra